Industry Application

Product Type

3 Ways the Biden Administration Could Impact the Battery Industry

| During his campaign, then President-elect Joe Biden revealed that his administration would allocate nearly $2 trillion toward the creation of a clean energy economy. Biden’s plan includes a $300 billion boost in federal R&D spending as well as a $400 billion procurement budget for sustainable energy products made in America.

Why are Battery Industry so important?Slashing greenhouse gases will require electrifying many things that now run on fossil fuels and generating that electricity with renewable power. But unlike traditional power plants that burn coal or natural gas, most renewable power sources can’t supply electricity all the time. Wind farms are useless on calm days, and solar panels produce nothing at night. Hence the need to store their energy. How are batteries used for green power?They’re not just in cars: Utilities across the U.S. have started plugging big batteries into the electric grid, both to back up the variable output of solar and wind farms and replace small “peaker” power plants that only run when electricity demand surges. California has been particularly aggressive, installing enough new grid-scale Battery Industry in 2020 to supply 572 megawatts of electricity, or 2,213 megawatt-hours. That’s enough to power roughly 430,000 homes for almost four hours. With these investments on the horizon, the Battery Industry can expect the incoming administration to play a much more active role in the development and production of battery technology. Here are three ways the Biden administration could impact the Battery Industry. 1. Accelerate the Pace of Battery Innovation Today, only 22% of America’s R&D expenditure comes from federal funds, while 73% comes from the private sector. By expanding federal R&D investments, the Biden administration may create more opportunities for American businesses, outside of established enterprises, to acquire the resources needed to conduct battery research, discover new energy storage solutions and provide mechanisms to get the innovation to market. The US has long been a leader in battery technology innovation but has been much less successful in capitalizing on the innovation in the marketplace. Future government grants would ideally come with improved incentives and mechanisms to accelerate innovation to market. The ability of the new administration to leverage technology innovation to create new jobs and combat climate change will be its measure of effectiveness. We’ve already seen the battery industry make great strides over the past decade. In 2010, the average cost of a lithium-ion battery pack for an electric vehicle (EV) was $1,160/kWh. Today, experts project that battery makers could cross the $100/kWh threshold by 2023, signaling cost parity of electric vehicles with traditional gas-powered vehicles. New federally-funded projects could accelerate that trajectory and EV adoption, and provide strategic differentiation of US EVs. 2. Foster Greater Demand for New Battery Technology The industry can also expect the government to drive new demand for battery-powered technology. Biden has specified that his administration would spend $400 billion on American-made products that use clean energy, many of which are battery-powered. One of the new administration’s goals is that all American-made buses be zero-emission by 2030. Such initiatives are a powerful way to support and grow strategically important component industries like the battery. This approach has been successfully implemented in the past. In the 1960s, nearly 100 percent of US semiconductors were purchased by the US government. The Biden administration has announced multiple focus areas, including the transit, automotive and power sectors, where it will direct federal purchases to US companies. Battery technology is an important component to these categories, and the ability of the government to pull US technologies through the value chain will accelerate technology commercialization and support the foundations of a North American supply chain. 3. Generate New Domestic Supply Chains and Jobs Finally, the Biden administration intends to launch new initiatives promoting domestic battery production in an effort to establish energy independence and create jobs. Building up American battery production won’t be easy. Battery production requires large capital investments, has razor thin margins and involves significant risk. Currently, over 80% of the world’s lithium-ion battery production happens in Asia Pacific. This creates significant challenges for the more than 10 EV IPOs which have occurred in the US over the past few years. China rules the battery business, producing 79% of the world’s supply, according to BloombergNEF. That’s no accident — the Chinese government years ago put batteries on the list of high-tech industries it wanted to dominate with its “Made in China 2025” initiative, funneling subsidies to domestic suppliers. The U.S. ranks a distant second, with 7% of global production. More domestic plants, however, are planned for Georgia, New York, North Carolina and Ohio. One limiting factor, however, has been U.S. access to the minerals needed, lithium in particular, most of which now comes from South America, Australia and China. The Advanced Technology Vehicle Manufacturing (ATVM) loan program (the government entity that gave Tesla a loan) faced downsizing in recent years. New backing under Biden, and the rise of similar assistance programs, may encourage more American companies to bring jobs and opportunities in battery manufacturing and distribution right onto US soil. With a New Administration Comes New OpportunitiesThe battery industry can anticipate broader support for research, production, and demand from the new administration. These predictions have caused an uptick in the price of lithium after a few sluggish years, signaling confidence in the coming match-up between EV raw materials supply and consumer demand. The time is ripe for American battery startups to shape America’s 21st century. About the author: Francis Wang, PhD is CEO of NanoGraf, an advanced battery material startup. |

A Guide to Choosing the Best 48V Lithium Golf Cart Battery

Would it be worth investing in a 48V ...

10 Exciting Ways To Use Your 12V Lithium Batteries

Back in 2016 when BSLBATT first began designing what would become the first drop-in replacemen...

BSLBATT Battery Company Receives Bulk Orders from North American Customers

BSLBATT®, a China Forklift battery manufacturer specializing in the material handling indust...

Fun Find Friday: BSLBATT Battery is coming to another great LogiMAT 2022

MEET US! VETTER’S EXHIBITION YEAR 2022! LogiMAT in Stuttgart: SMART – SUSTAINABLE – SAF...

Looking for new Distributors and Dealers for BSL Lithium Batteries

BSLBATT battery is a fast-paced, high-growth (200% YoY ) hi-tech company that is leading the a...

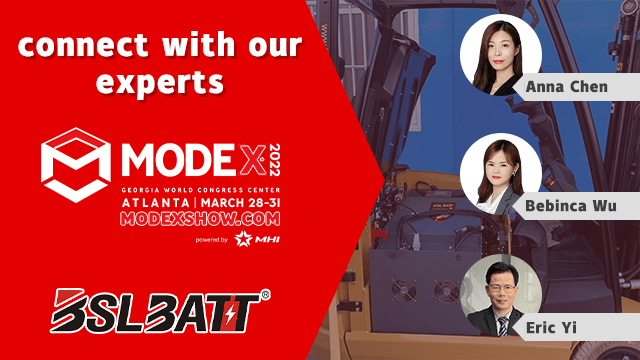

BSLBATT to Participate at MODEX 2022 on March 28-31 in Atlanta, GA

BSLBATT is one of the largest developers, manufacturers, and integrators of lithium-ion batter...

What makes the BSLBATT the Superior Lithium Battery for your Motive Power needs?

Electric forklift and Floor Cleaning Machines owners who seek the ultimate performance will fi...