Industry Application

Product Type

Ningde era 2018 performance report: revenue increased by 48.08%, net profit fell by 7.71%

| On February 27th, the Ningde era released its 2018 performance report. The express report shows that the Ningde era achieved a total operating income of 29.611 billion yuan in 2018, a year-on-year increase of 48.08%, but the net value attributable to shareholders of listed companies. The profit was 3.579 billion yuan, down 7.71% year-on-year.

However, after deducting non-recurring gains and losses, the annual net profit attributable to the listed company was 3.11 billion yuan, a year-on-year increase of 30.95%. For the reason of the rapid growth in 2018, the Ningde era analyzed the reason in the express report mainly because of the rapid growth of the demand for the power battery market brought about by the rapid growth of the new energy vehicle market. At the same time, the Ningde era also pointed out that in the new energy vehicle industry subsidy adjustment, technical requirements and other industries standardization, market changes in the broader environment, by strengthening the market development, and by increasing production capacity, control costs and other modes, so that sales Continued growth has further increased market share and effectively reduced costs. In response to the decline in net profit, the Ningde era explained in the Express that the disposal proceeds from the transfer of Beijing Pride New Energy Battery Technology Co., Ltd. during the same period last year affected the company’s annual net profit. The company established in 2011, in 2018, only used 24 days to “lightning” the meeting, and after the listing, it ushered in several daily limit boards, and climbed the market value of the GEM “new one.” At the same time, the market value of the Ningde era has exceeded the “big brother” BYD of the domestic new energy vehicle power battery. As of the close of February 27, the market value of the Ningde era was 188.88 billion. Among the Chinese auto companies and related industrial chain enterprises, the market value of the Ningde era was second only to SAIC. In addition, with the rapid development of China’s new energy automobile industry, the Ningde era has become the scent of car companies. Many Chinese first-tier car companies are “deeply bound” with the Ningde era. By the end of 2018, the Ningde era had already taken care of auto companies such as Auto, Dongfeng, Guangzhou Automobile and Geely, and established six joint venture battery companies. Car companies are reluctant to be “passive” in the battery supply chain. For car companies, in order to popularize electric vehicles on a larger scale, it is necessary to reduce costs and form certain technological advantages. The self-built or integrated battery enterprise construction is dedicated to its own battery factory, which is beneficial to the car enterprises to ensure the high quality supply of batteries. In 2019, the “friend circle” of the Ningde era is still expanding. On February 25, the Ningde era announced that the company signed a five-year long-term strategic cooperation agreement with BAIC New Energy and Beijing Pride New Energy Battery Technology Co., Ltd. In the 21st century, the economic report reporter recently found out that the new joint venture company of the Ningde era and FAW Group, FAW Power Battery Co., Ltd., was registered on January 31 this year with a registered capital of 2 billion yuan. Among them, Ningde era invested 1.02 billion yuan, with a shareholding ratio of 51%; FAW Group invested 980 million yuan, with a shareholding ratio of 49%. At this point, the Ningde era has reached a deeper cooperative relationship with the three central enterprises of the automobile industry and the three state-owned enterprises of the North, Shanghai and Guangzhou. However, it is worth noting that for the fast-expanding Ningde era, the future also implies “risk.” In addition to BYD’s upcoming opening of the power battery supply, Japan and South Korea’s power battery company is making a comeback, vowing to face a positive confrontation with the Chinese power battery companies in the market after subsidies. The industry believes that the cost of lithium-ion batteries will continue to decrease at this stage, and the Ningde era, as China’s leading power battery company, relies on its own research and development and policy support, and the cost will have a large room for future decline. Source: China business news, 21st century business herald |

A Guide to Choosing the Best 48V Lithium Golf Cart Battery

Would it be worth investing in a 48V ...

10 Exciting Ways To Use Your 12V Lithium Batteries

Back in 2016 when BSLBATT first began designing what would become the first drop-in replacemen...

BSLBATT Battery Company Receives Bulk Orders from North American Customers

BSLBATT®, a China Forklift battery manufacturer specializing in the material handling indust...

Fun Find Friday: BSLBATT Battery is coming to another great LogiMAT 2022

MEET US! VETTER’S EXHIBITION YEAR 2022! LogiMAT in Stuttgart: SMART – SUSTAINABLE – SAF...

Looking for new Distributors and Dealers for BSL Lithium Batteries

BSLBATT battery is a fast-paced, high-growth (200% YoY ) hi-tech company that is leading the a...

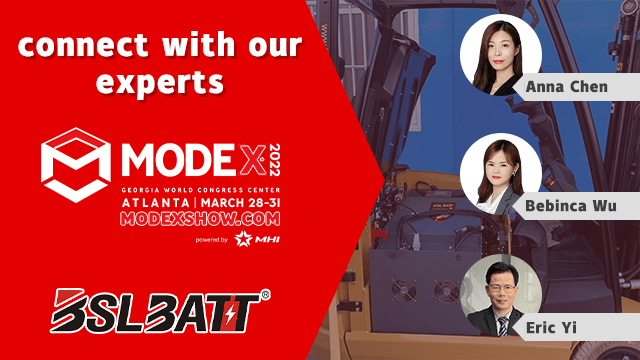

BSLBATT to Participate at MODEX 2022 on March 28-31 in Atlanta, GA

BSLBATT is one of the largest developers, manufacturers, and integrators of lithium-ion batter...

What makes the BSLBATT the Superior Lithium Battery for your Motive Power needs?

Electric forklift and Floor Cleaning Machines owners who seek the ultimate performance will fi...